Welcome to Marino Filiplic Financial

WE HELP TO

MITIGATE RISK

ANDGROW

YOUR LEGACY

Building The Foundation For Yourself, Family, Children, And Generations To Come.

Welcome to Marino Filiplic Financial

WE HELP ENTREPRENEURS

BUILD WEALTH, PROTECT WEALTH, and GROW YOUR LEGACY

Building The Foundation For You, Family, and Generations To Come.

Business Owners & Executives

Customized financial solutions to help optimize your wealth, reduce taxes efficiently, mitigate risk, and intergenerational legacy.

Incorporated Professionals

Financial guidance tailored to your specific practice and increase your personal cash flow.

Individuals & Families

Customizable financial strategies to help you grow your wealth, mitigate risk through insurance, and provide a legacy to those that are most important to you.

Business Owners & Executives

Customized financial solutions to help optimize your wealth, reduce taxes efficiently, mitigate risk, and intergenerational legacy.

Incorporated Professionals

Financial guidance tailored to your specific practice and increase your personal cash flow.

Individuals & Families

Customizable financial strategies to help you grow your wealth, mitigate risk through insurance, and provide a legacy to those that are most important to you.

------- About Us -------

“Your money. Your terms”

Building the Foundation for yourself, family, children, and generations to come.

Our Objective:

Create a service based company whose primary commitment is to exceed the expectations of our clients.

Design and implement a business strategy that meets the long-term needs of our clients for passive income, asset protection, and mitigating taxes. We implement this strategy through powerful in-house solutions and strategic partnerships that offer significant near-term benefits.

Positively impact the wealth, health, and well-being and long-term prosperity to our clients. We accomplish this by sharing cutting-edge products, services, and education.

Instill confidence in our clients with the best in class wealth enhancement plan that leads the industry in creativity and generosity.

Compass Blueprint

About Us -------

“Your money. Your terms”

Building the Foundation for you, family, and generations to come.

To make an IMPACT on people’s lives. Creating results that will be TRANSFORMATIONAL and LIFE CHANGING.

Our Objective:

Create a service based company whose primary commitment is to exceed the expectations of our clients.

Design and implement a business strategy that meets the long-term needs of our clients for passive income, asset protection, and mitigating taxes. We implement this strategy through powerful in-house solutions and strategic partnerships that offer significant near-term benefits.

Positively affect the wealth, health, and well-being and long-term prosperity to our clients. We accomplish this by sharing cutting-edge products, services, and education.

Instill confidence in our clients with the best in class wealth plan that leads the industry in creativity and generosity.

Compass Blueprint

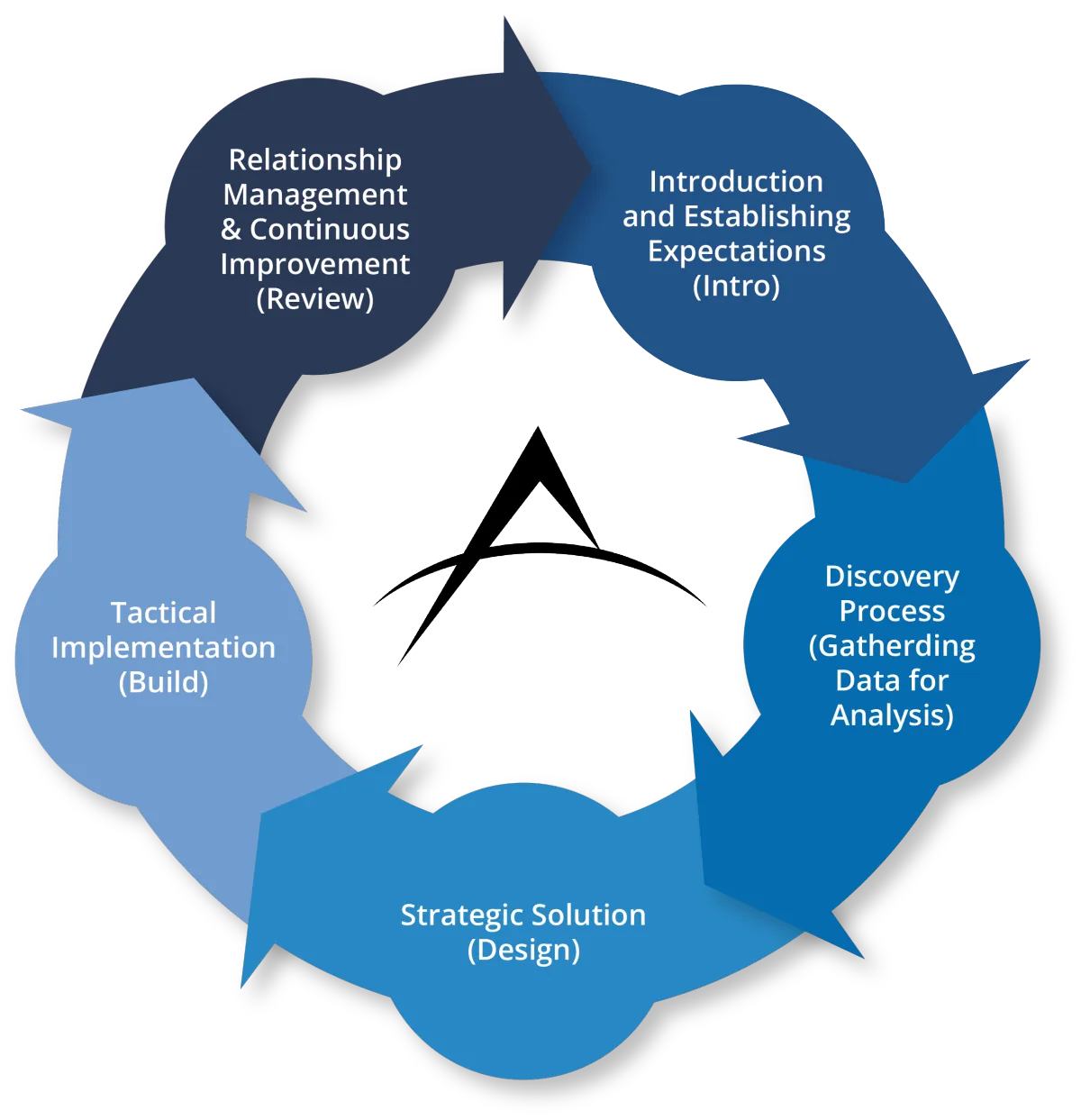

Our Process

Our process is broken down into four (5) steps so that we can demonstrate tax efficiencies by a factor of 5X and sometimes up to 10X. The result favors the long term approach to maximizing tax efficiencies and minimizing the impact of estate taxes on wealth and legacy of the person(s).

Introduction and Establishing Expectations (Intro)

Meeting introduction with the team: Determine what the expectation(s) are for both parties. Defining terms of the professional relationship. Establishing an engagement letter that outlines the scope of work.

The Discovery Process (Analysis)

What is the financial goal, the lifestyle goal, the legacy goal, and the benefits you want to receive through integrating insurance based strategies into your tax and estate plan. Determine if there is a good fit for both parties. Gather all information to conduct a thorough assessment from you the client themselves and the client’s professional advisory team are able to provide all the data required.

The Strategic Solution (Design)

A detailed customized insurance based strategy best suited to the client’s tax, financial planning, estate planning, and legacy objectives. This collaboration is done with a team of professional experts working in concert with you the client and your legal, accounting, tax, and other professional advisors.

The Tactical Implementation (Build)

Once all parties agree to move forward, we will arrange, oversee, and guide you (client) through the underwriting process and funding to secure the most effective insurance based solution available in the marketplace.

Relationship Management through Continuous Improvement Program (Review)

The Continuous Improvement Program is dynamic and designed to ensure that the tactical implementation is optimally maintained and continues to achieve a client’s objective as to the personal, financial, and corporate circumstances.

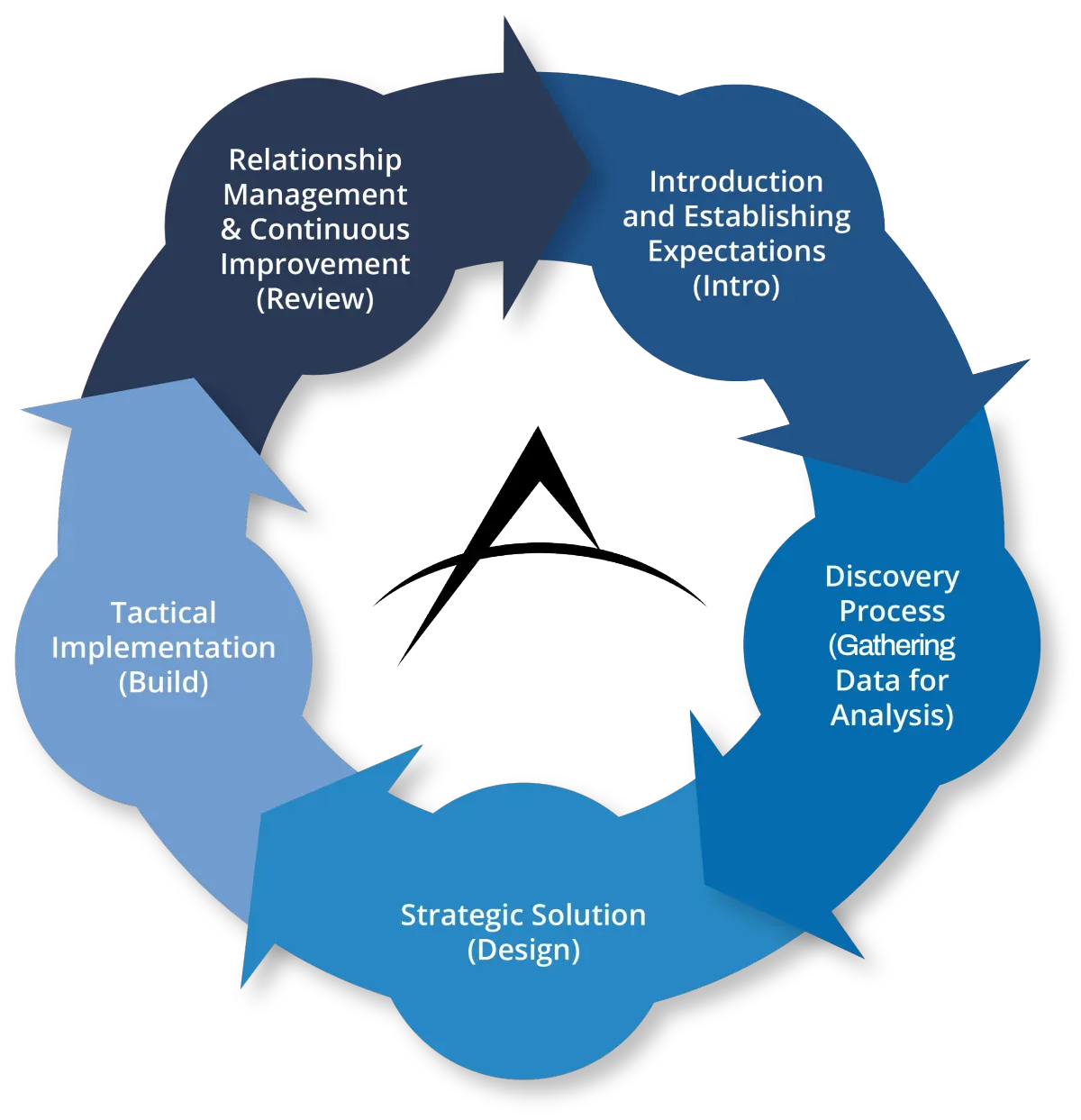

Our Process

Our process is broken down into four (5) steps so that we can demonstrate tax efficiencies by a factor of 5X and sometimes up to 10X. The result favors the long term approach to maximizing tax efficiencies and minimizing the impact of estate taxes on wealth and legacy of the person(s).

1. Introduction and Establishing Expectations (Intro)

Meeting introduction with the team: Determine what the expectation(s) are for both parties. Defining terms of the professional relationship. Establishing an engagement letter that outlines the scope of work.

2. The Discovery Process (Analysis)

What is the financial goal, the lifestyle goal, the legacy goal, and the benefits you want to receive through integrating insurance based strategies into your tax and estate plan. Determine if there is a good fit for both parties. Gather all information to conduct a thorough assessment from you the client themselves and the client’s professional advisory team are able to provide all the data required.

3. The Strategic Solution (Design)

A detailed customized insurance based strategy best suited to the client’s tax, financial planning, estate planning, and legacy objectives. This collaboration is done with a team of professional experts working in concert with you the client and your legal, accounting, tax, and other professional advisors.

4. The Tactical Implementation (Build)

Once all parties agree to move forward, we will arrange, oversee, and guide you (client) through the underwriting process and funding to secure the most effective insurance based solution available in the marketplace.

5. Relationship Management through Continuous Improvement Program (Review)

The Continuous Improvement Program is dynamic and designed to ensure that the tactical implementation is optimally maintained and continues to achieve a client’s objective as to their personal, financial, and corporate outcomes.

--------- What we do ----------

Our Services

Corporate Planning

Advanced Tax Strategies

Corporate Structure

Transition Planning

Review Buy/Sell Agreement

Wealth Management

Accumulation Planning

Investment Management

Retirement Planning

Divorce & Separation Planning

Estate Planning

Tax Reduction Strategies

Wills and Power of Attorney

Wealth Transfer Planning

Trusts

Tax Specialization

Incorporated Professionals

Individual Pension Plans

Personal Retirement Accounts

Immediate Financing Arrangements

Risk Management

Disability and Critical Illness Protection

Life Insurance Analysis

Annuities and Segregated Funds

Group Benefits Review

Philanthropy

Charitable Giving Strategies

Legacy Planning

Donating Securities & Life Insurance

Policies

Tax Benefit Assessments

--------- What we do ----------

Our Services

Corporate Planning

Advanced Tax Strategies

Corporate Structure

Transition Planning

Buy/Sell Agreement Executive Health Account

Wealth Management

Accumulation Planning

Investment Management

Retirement Planning

Estate Planning

Tax Reduction Strategies

Wills and Power of Attorney

Wealth Transfer Planning

Trusts

Tax Specialization

Incorporated Professionals

Individual Pension Plans

Personal Retirement Accounts

Immediate Financing Arrangements

Risk Management

Health Care Fund

Income Replacement

Life Insurance Analysis

Annuities and Segregated Funds

Group Benefits Review

Philanthropy

Charitable Giving Strategies

Legacy Planning

Donating Securities & Life Insurance

Policies

Tax Benefit Assessments

Marino Filiplic

Principal, Risk Manager

Marino Filiplic

Principal, Risk Manager

----------- Testimonials ------------

Happy Clients

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Rahina

Customer

----------- Testimonials ------------

Happy Clients

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Rahina

Customer

--------- Partners ----------

We’re Working With